UPDATE: This analysis was updated on August 16, 2022, to include newly released data on the Consumer Price Index (CPI) for July 2022.

From record-high gas prices, to growing grocery bills, Albertans are feeling the impacts of the rising cost of living. And without proper solutions, this crisis will only continue to get worse. To address this problem, we must abandon conventional policy responses that place the blame for rising costs on workers, and instead tackle the true cause of increasing costs: corporate profiteering.

What is inflation?

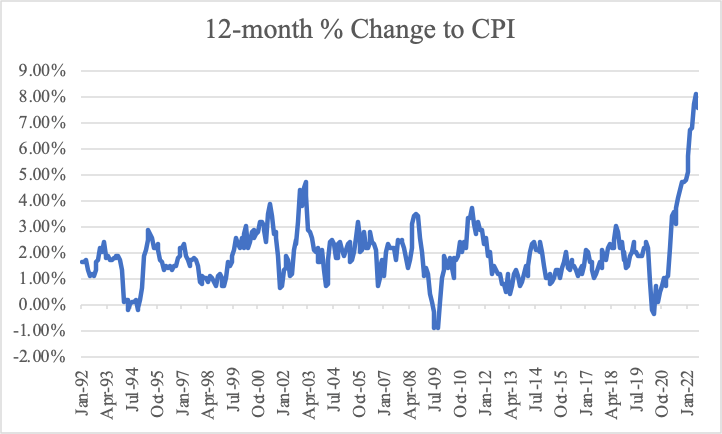

Inflation is defined as the broad increase in price of goods and services. In Canada, inflation is rising at a level not seen in nearly 40 years. Economists measure this through the 12-month change in the Consumer Price Index (CPI), a measurement that gauges the cost of a fixed basket of goods and services. In June, the CPI increased by 8.1 per cent, the highest increase since January 1983.

The latest numbers for July put inflation at 7.6 per cent — a drop from previous months but still shocking to most Canadians, after increases to the CPI mostly remained between one to three per cent since the 1990s. The latter largely reflects where people believe inflation should be, as the Bank of Canada is legally required to aim for a target of 2 per cent inflation. As a result, Canadians are feeling the immense pressure that increased costs are having on their wallets, especially when purchasing goods like gasoline and groceries, where prices are skyrocketing even faster.

In fact, gasoline is the good that is increasing at the fastest rate. In June, gasoline prices rose by 54.6 per cent in the last year. The situation improved in July but, if we exclude gasoline from CPI, inflation would decrease a full percentage point.

“Over the past two years, Albertans sacrificed a tremendous amount to protect their communities during an unprecedented global pandemic,” says Gil McGowan, president of the Alberta Federation of Labour. “Now, workers are suffering under a cost of living crisis, one that prevents them from accessing essential goods, like groceries.”

Source: Statistics Canada

Sadly, Canadian workers aren’t alone in facing this crisis. Across the world, many countries are experiencing high levels of inflation, such as the United States, United Kingdom, and Germany.

Corporations are driving up inflation, not workers

Clearly, the status quo is not sustainable. If we want working-class Albertans to have a good standard of living, we must tackle inflation and the core causes that are driving costs up. Importantly, this involves combatting the myth that workers are behind the rise in inflation.

The reason conservative politicians and bureaucrats blame workers for this issue is because their economic models assume inflation is driven by an increased cost of labour. They assert this happens during times where the unemployment rate is low, and employers must actively compete for workers by setting fair wages and creating good working conditions, rather than relying on cheap labour. Free-market economists claim this increased cost of labour is passed along to consumers in the form of increased prices. This incentivizes policymakers to throw workers under the bus, with high-profile economists such as Andrew Bailey, the governor of the Bank of England, asserting that workers shouldn’t be asking for pay raises during the inflation crisis.

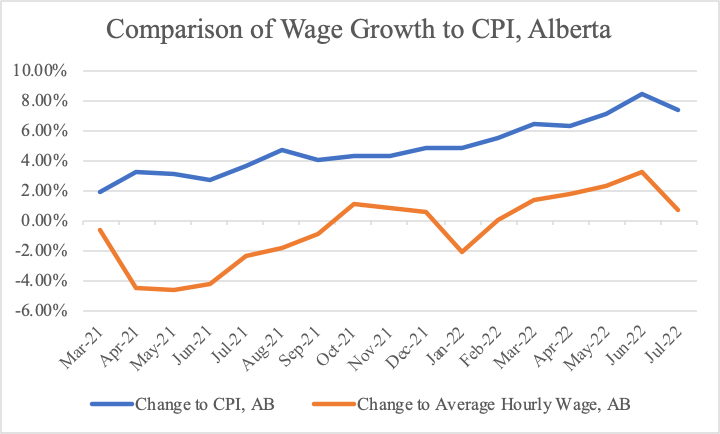

Of course, this rhetoric isn’t backed up by the facts. In reality, wages are growing at a rate much slower than inflation. In July, Canadian wages increased by 5.2 per cent, while prices increased by 7.6 per cent. Sadly, this situation is considerably worse in Alberta: currently, wages are growing by a meager 0.7 per cent, while inflation is rising by 7.4 per cent. This means prices are growing over twice as fast as wages in our province, leaving workers with a substantial cut to their real wages.

Source: Alberta Federation of Labour’s calculations from Statistics Canada data.

Simply put, the idea that workers and our demands for fair wages are driving up inflation is laughable. But, if wages aren’t driving up inflation, what is?

The largest factor, in reality, is corporate greed and profiteering. As prices rise, so too have the profits of big corporations. In the first quarter of 2022, after-tax corporate profits rose to their highest share of GDP ever recorded, 18.8 per cent. This means that, as most families were debating whether they could afford their groceries, CEOs increased their slice of the economic pie. Other statistics suggest this as well, with wholesale and retail margins increasing sharply after Canadian governments began lifting pandemic regulations in 2021, much faster than inflation.

It’s important to acknowledge that there are other factors partially responsible for inflation. This includes higher energy prices due to the Russian-Ukrainian war; supply chain issues caused by both the re-opening of the global economy and decades of underinvestment; and pent-up consumer demand following the lifting of many public health regulations.

Yet, even when considering these factors, big corporations are raising prices far more than is required to offset these additional costs. Research from fuel analysts show how big oil companies are price-gouging to increase their profit margins. Take Calgary, for example, where one researcher estimated that retailers were charging an extra 15 to 20 cents per litre solely for additional profits. An independent investigation by the Toronto Star found that Canada’s three largest supermarket chains are rising prices higher than is necessary to line their pockets. Data from other countries show similar trends are behind the rise in inflation in other Western liberal democracies. Clearly, there is a consistent problem in corporate Canada.

Too often, companies get away with this behaviour due to corporate concentration. Grocery stores are a great example of this, with the top five Canadian retailers making up 80 per cent of the market. Without competition from other companies, CEOs have an easier time increasing prices, provided their competitors remain similarly priced. In fact, corporations can agree to mutually increase prices — a process known as “price fixing.” Despite the fact that price fixing is illegal, many corporations still do it, with a notable example being Loblaw, which admitted to bread price fixing in 2017.

While corporate concentration in Canada was a serious problem before 2020, the COVID-19 pandemic made the issue worse. Under the severe economic conditions, many independent businesses went under, increasing the market share of large corporations.

Overall, the evidence shows that greedy employers are responsible for the rising cost of living — not workers.

Increasing interest rates will only erode worker power, as was the case in the 1970s

Instead of holding corporations accountable, complacent politicians and economists are unfortunately proposing solutions that will harm workers, rather than protect them.

The most conventional policy response to inflation is increasing interest rates through central banks. This is already underway in Canada, where the Bank of Canada has repeatedly hiked interest rates, with the last one-time increase being the largest since 1998. The logic behind raising interest rates is that, due to the higher price of borrowing money, business investment will decrease and unemployment will subsequently rise. With less money and jobs, conservatives expect prices to fall to a lower point, dampening inflation regardless of the cost to workers.

Lawrence Summers, a former American treasury secretary and well-known economist, embodies this mentality perfectly. In a series of interviews, Summers has repeatedly advocated for central banks to steeply increase interest rates and even said that, to decrease inflation to a target goal of two per cent, we would need unemployment to massively increase. In his mind, countries would need the equivalent of five years of unemployment above 5 per cent to bring down inflation, despite this entailing the destruction of thousands of jobs.

In the Canadian context, we have plenty of reason to fear interest rates will increase unemployment. An analysis conducted by economist David MacDonald found that, any time the Bank of Canada has tried to decrease the CPI by 5.7 percentage points, the move has always been followed by an economic recession. In fact, there’s data showing employment and labour force participation have already dropped since interest rates increased — there’s been a loss of 74,000 jobs since May and 225,000 workers who’ve left the labour market since March.

The latest batch of data from Statistics Canada proves how interest rates rely on the destruction of jobs to lower inflation. In July, inflation rose by 7.6 per cent —still a historically high number for Canada but a decline from the CPI change in June. While central bankers and pundits view this as a reason to continue increasing interest rates, it’s important to emphasize that this decline is accompanied by a loss of jobs. In the same month, the Canadian economy lost roughly 31,000 jobs — adding to the jobs already lost over previous months. Canadians have lost 74,000 jobs in total since May.

The most damaging statistic, however, is arguably the decline in labor force participation. Since the Bank of Canada began raising interest rates in March, the number of workers participating in the labour market has declined by 0.7 per cent — representing a loss of 225,000 workers. These statistics show us the damage that interest rates are already having on the economy and workers. Meanwhile, even as the CPI decelerated for July, costs continued to increase for common goods and services. Food is a prime example of this, with groceries increasing by 9.9 per cent since last year, the largest increase since 1981.

What this data shows us is that increasing interest rates is needlessly painful for workers and does nothing to address the corporate greed driving the latest increase in inflation. Instead, it relies on the notion that workers should be punished for causing inflation — something we know is false.

“When it comes to dealing with the growing cost of living, Albertans are already paying a steep price,” says McGowan. “Now, conservative economists want them to pay for the solution in the form of increased interest rates, a policy which will needlessly kill the economy, destroy jobs, and leave the working class worse off than they were before,” the AFL leader adds.

To support their decisions, policymakers will often invoke memories of the 1970s and 1980s, when increasing interest rates was seen as the only option to deal with runaway inflation. However, this analogy misses how much the policies of the past damaged working-class Canadians and unions. Canada was thrown into a recession, economic growth slowed, and unemployment rose sharply — all factors that deeply hurt workers and the Canadian labour movement.

The rate of union density, which reached its peak in the early 1980s, has been in a slow state of decline ever since 1990. Governments adopted more restrictive labour policies and power remained concentrated in the hands of big business.

Worse, unions lost one of their core protections against inflation — the cost-of-living adjustment (COLA) clauses. These clauses, built into collective agreements, protected workers from rising prices by contractually ensuring that wages kept pace with the cost of living. In the late 1970s and early 1980s, COLA clauses were much more common, with 20 to 30 per cent of major wage settlements containing them. Yet, starting in 1990, COLA clauses started to decline, to the point where only one major wage settlement contained a COLA clause in 2018.

Source: Alberta Federation of Labour’s calculations based on data from Statistics Canada.

If we leave addressing inflation to the central bankers and complacent politicians, we risk having a dramatically lower standard of living for the next generation of workers. Not only will their response lead to a potential recession, but the subsequent impacts of an economic downturn could disempower unions in the long-term, leaving workers without a voice.

“The labour movement and worker power were set back by the previous response to inflation,” McGowan notes. “We can’t afford to repeat these mistakes today.”

We need a progressive response to inflation, one that protects workers

Instead of scapegoating workers for the cost-of-living crisis, we need a response that will protect working-class Albertans and address the real roots of inflation by putting an end to corporate price gouging.

In terms of government action, this begins with redistributing wealth from big business by implementing an excess profits or ‘windfall’ tax. This policy would see the government collect a levy on the excess profits of companies that are profiteering. Not only would this fiscal policy discourage price gouging, but the funds generated by the tax could be reinvested in working class people.

Let’s be clear — this is not a radical policy, nor is it a new idea. Countries such as Italy and Spain have already implemented excess profit taxes. Even the Conservative government in the U.K. has implemented a 25 per cent tax on excess profits in the energy industry. It is high time the Canadian government use the same solution.

To ensure this money returns to workers and costs begin to decline, governments should invest the revenue into the public provision of goods and services in key industries experiencing high inflation. For example, Canada could use this money to build more affordable housing units, bringing down the cost of housing for everyday Albertans. The money could also be used to spur diversification in the Alberta economy.

Another key action government can take is implementing price controls or regulations in industries with high corporate concentration. Examples could include rent control or regulating prices of gasoline or natural gas for home heating. Instead of abandoning consumers to monopolistic regimes, these price controls will reign in price gouging in the short-term.

In the long-term, governments should break up corporate concentration by enhancing the Competition Act, ensuring free and fair competition in the marketplace. Through revamped oversight and punishment of anti-competitive practices, corporations can be constrained from engaging in anti-competitive practices and gouging consumers.

Finally, the last action governments can take is making it easier for Albertans to unionize. Unions provide workers with a voice and ensure that they are treated with dignity and respect on the job. Corporations are scared of unions because they know that our collective power is the only effective counterbalance to their greed and wealth. Making it easier for workers to unionize is important to ensuring that we increase wages to match the rising cost of living. An example of potential reform could be implementing single-step union certification in Alberta, also known as card-check certification, similar to other provinces.

Getting wins for workers and the labour movement

To accomplish real wins for workers, we must also move beyond government actions. Labour unions must seize on this moment to take collective action and protect more workers from receiving real wage cuts. While rising inflation is undoubtedly a stressful challenge, it also presents an opportunity for the labour movement to educate, organize, and secure economic justice for all Albertans.

The first, and most important, step labour unions can take is securing COLA clauses in their collective agreements. As mentioned earlier, these clauses used to be commonplace but were often bargained away during the long period of low inflation rates. But the current situation suggests that if we want wages to keep pace with the rising cost of living, we need COLA clauses back. These clauses not only protect current employees but ensure that future generations of workers are protected from increases in inflation. Bringing back COLA clauses will go a long way in securing the longevity and strength of the labour movement.

The next action labour unions can take is educating both the public and their members on the true causes of inflation. Despite the evidence that inflation is outpacing wage growth, a strong narrative still exists that the rising cost of living is the fault of growing labour costs. Reactionary pundits, politicians, and economists have spread this false information for years and are well ahead of us on spreading messages about inflation. We need to combat this narrative with one of our own that raises collective awareness about how corporations are asking workers to pay a steep price to clean up their mess.

Lastly, labour unions need to use this moment to organize and expand unionization. We know working-class Albertans are struggling to get by. As inflation continues to rise, this struggle is only going to get worse. This is a prime moment for working-class Albertans to unite together, in solidarity with the broader labour movement, to exercise their collective power and defend themselves from the vested powers of corporations. The Alberta Federation of Labour, along with affiliated unions across the province, has an important role to play in supporting this effort.

We are at a unique moment to undertake this work. Increasingly, more and more Albertans are recognizing the value of labour unions, and they are beginning to organize in their workplaces. From Starbucks to Amazon, unionization efforts are starting to take off at various large corporations. Such efforts would have been considered unthinkable only a few years ago. What this means for the worker movement is that nothing is impossible when we exercise our collective power — and, as we collectively grapple with the rising cost of living, we must stand in solidarity with each other to continue organizing and expanding our movement.

“All workers deserve a fair wage and a good standard of living,” McGowan says. “In face of relentless inflation, we must band together to increase worker power and secure real wins for Albertans. Looking at our history, we know we can’t rely on politicians and political elites to do this for us — we must use our collective voice and get the job done ourselves.”